What’s important about the order-to-cash cycle?

An agile and efficient order-to-cash (O2C) cycle can have a huge impact on the success of your company, whether you are an SMB or a global organization. By successfully managing and optimizing certain stages of the O2C process you can drive down costs, remove inefficiencies and get paid on time for your products and services.

According to McKinsey, O2C is one of the most complex general and administrative (G&A) processes, which typically comprises between 1-3% of a company’s revenue base. But, for some organizations, it is worth putting the effort and additional resources into transforming O2C processes. For example, McKinsey notes for industrial manufacturers, medical distributors and similar organizations reported results of $6 in return for every $1 invested in O2C optimization.

So, where to start? Here, we focus on practical tips to demonstrate the benefits of optimizing certain aspects of the payment process, which begins as soon as a customer order is received.

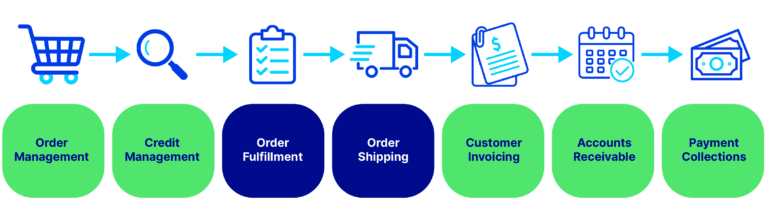

The 8 important steps in the O2C process

- Order Management

- Order Fulfilment

- Order Shipping

- Reporting and Data Management

Tip 1: Offer instant purchasing power at checkout

Each step in the O2C cycle is interconnected. At the order management stage, it is important to consider offering alternative financing options, such as trade credit. Trade credit is a type of B2B financing that enables businesses to receive goods from suppliers before paying for them. The approval process and payment terms of the suppliers providing the credit will vary. They usually offer 30, 60 or 90 days (often known as net terms). However, managing a trade credit solution in-house can be costly both in time and resources. Consider engaging a third-party partner with sophisticated technology and expertise in this area, with rapid customer onboarding via a one-time digital application.

Tip 2: Eliminate the risk of underwriting and managing credit offerings

B2B businesses looking to digitally transform the customer payments experience must evaluate the risk of underwriting and managing alternative finance offerings. Poor credit management can cause issues with processing orders that will in turn negatively impact cash flow and customer relationships. Outsourcing this step in the process eliminates the risk of underwriting and the burden of manually deciding credit limits. As part of an entirely digital process with real-time decision-making, your customers can be credit checked and approved.

Tip 3: Keep costs down with electronic invoicing

Issuing an invoice may seem like a simple step, but complexities can disrupt the payment process. E-invoicing is now a must in many geographies. By digitizing your invoicing process, you can keep costs down, while improving the accuracy of the invoices including purchase order details. Invoices can be issued instantly, and inaccuracies avoided by removing the element of inputting manual data. This in turn, drastically reduces the number of errors.

If you are accepting international orders, working with a third party that understands the intricacies of global currency conversion is also a bonus. If this is not invoiced correctly it can lead to disputes relating to overcharging and underpaying.

Tip 4: Rejuvenate your Accounts Receivables (A/R)

Traditional A/R processes should be a thing of the past when examining a modern order-to-cash process. Automating A/R means invoices can be issued instantly, with shorter payment terms and incentivized discounts. The speedy conversion of receivables improves your cash flow, which can then be allocated for use elsewhere in your business.

Effective A/R management will help you predict the cash flow. This is an important step as it can cause issues with the overall management of finances in your business.

Tip 5: Speed-up your payment collections

Consider a world with no worries about collections. This can be a reality with an outsourced digitized collection process. If your customers default on the payment, you can still get paid as the third-party provider takes care of the debt collection. Payment collection is the penultimate stage of processing the payment in the O2C cycle and quicker collection means a positive record on your general ledger.

Order-to Cash: The Key to Digital Transformation Success

Order-to-cash digital transformation is an area worth investing in. There is value in the O2C cycle that can be unlocked for businesses, particularly when considering using a third-party outsourced provider. The O2C cycle is complex. To overcome operational inefficiency, integration challenges and too many reconciliation payment points, the O2C processes require integrated and unified solutions that can support multiple digital payment methods.